The Three Cs Create A Dynamic Moment for MSPs

By Mike McGill and Kevin Jolley, Cowen and Company, LLC

Industry insiders say the cloud, after-effects of the COVID pandemic, and industry consolidation are combining to create a bright future.

It’s a great time to be in the MSP business. The industry finds itself uplifted by a whirlwind of three forces – cloud migration, COVID, and consolidation - that together are creating sunny days for MSP owners and operators.

A series of conversations with top executives and entrepreneurs from the MSP world, as well as with significant PE investors in the industry, found a sense of aggressive optimism about MSPs’ prospects, and with good reasons:

- Managed Services is a large and growing market. Revenue continues to increase as SME customers continue their decades-long movement to the cloud at an ever-increasing pace.

- Technology and security are both increasing in complexity, making the ability to support IT in-house more difficult and more expensive.

- The COVID pandemic has completely rewritten the norms of worker proximity and location, necessitating new forms of support and security assistance. Rigid government-imposed quarantines are giving way to post-vaccination hybrid office/home office flexibility, cementing the need for additional MSP support.

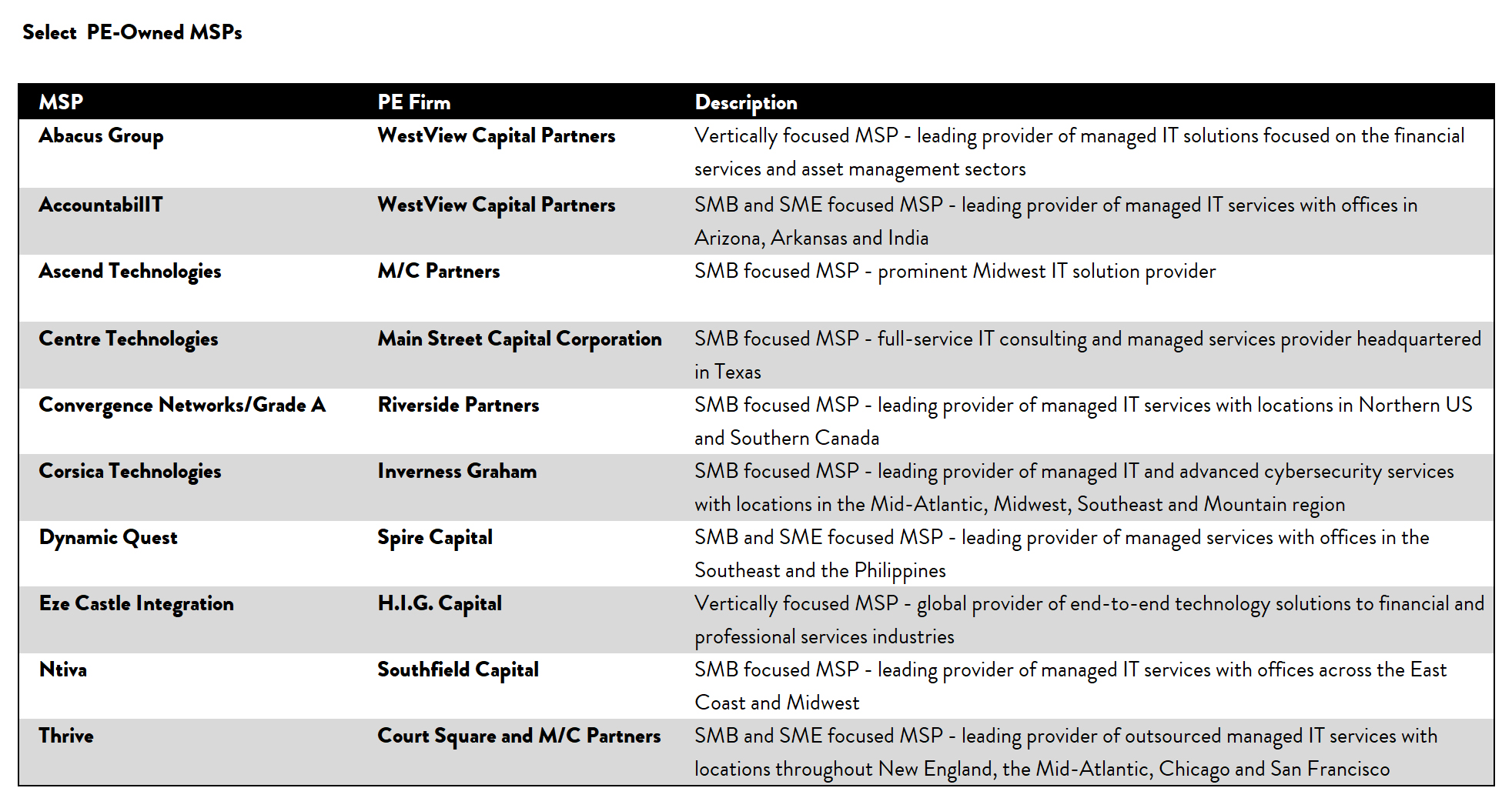

- MSPs are proving a perfect match for private equity’s affection for predictable, growing cash flows and asset-light, high-margin businesses. Against a backdrop of recent record levels of PE activity, MSP valuations are high and could crank even higher. Industry consolidation appears to be underway.

But that doesn’t mean there are no challenges for MSPs:

- Tricky strategic and competitive decisions lie ahead as MSPs wrestle with plans for industry specialization, MSP/MSSP (managed security services providers) service delineation, and new market entrants.

- Decisions must be made about staffing, training, and facilities to support post-COVID business models. What will snap back to “old ways” and what won’t for MSP customers – and how do MSPs avoid making the wrong bet?

- Talent remains a key scaling factor, and the competition for skilled people feels more intense than ever.

- The consolidation wave is creating new competitive pressures from MSPs with new-found scale and resources.

- Questions about MSP valuations, the practical realities of partnering with a PE firm to grow, and what happens if MSPs miss the consolidation wave abound.

What lies ahead for MSPs and their stakeholders? Will the uplift continue to drive business forward? What are the best strategic choices for capitalizing on the secular growth trends from cloud and COVID?

MSP Demand Outlook

Demand for managed services is strong and growing – and market penetration is low. It’s every industry’s dream scenario.

“Studies we’ve looked at suggest that only about 30-40 percent of the potential SMB market has actually been penetrated,” said David Del Papa, General Partner at Riverside Partners, which owns Convergence Networks/Grade A. “And we’re seeing lots of first-time outsourcers among our new customers.”

Those first-time outsourcers are being driven by the growing complexity of IT and connectivity – but also by growing security risks. Both of those factors, in turn, are driven by the migration of so much of the IT stack to the cloud.

“Cloud adoption is accelerating,” said Chris Pace, CEO of Houston-based MSP Centre Technologies. “We’re seeing more pressure coming from customer C-suites to move their companies to the public cloud, but also to make sure security is fully covered. Of course, those two things don’t naturally go together. Setting a strong and reliable security defense for the public cloud brings an entirely new set of challenges, and if you lack the expertise to set it up or manage it correctly, it could result in a very costly mistake. That’s just one reason we’re seeing more companies conclude they need an MSP partner.”

There is one element of the cloud migration that’s acting as a drag on MSP revenue, however. “The business is just less and less about reselling hardware,” said Centre’s Pace. “The hardware decline is moving faster than I’ve ever seen it,” he added.

Cloud Migration And Security Strategy

The relatively clean divide between MSPs and MSSPs may be blurring a bit because of migration to the cloud and the cornucopia of cybersecurity risks it presents. The old division of labor had MSPs oriented more toward hands-on, on-premises IT services, while MSSPs need a dedicated 24/7 security operations center (SOC).

But increased awareness of public cloud security needs is driving demand for outsourced solutions, and customers like the simplicity of fewer vendors.

“My perception is that MSPs are being hired by clients for risk mitigation as well as for managing cutting-edge tech,” said Heb James, Partner at Southfield Capital, which owns McLean, Va.-based MSP Ntiva.

And with that comes strategic choices for MSPs. Do they continue to re-sell or partner with a separate MSSP, consider the acquisition of an MSSP, or attempt to build the capability in-house?

“We’ve tried to be more proactive in dealing with security demands,” said Paul Nolen, Managing Principal at Inverness Graham Investments, which owns Corsica Technologies. “Corsica acquired two SOCs through acquisition. Minutes can matter in security breaches, so we think having the capability to monitor cybersecurity threats and then also to take action through an incident response team (the response capability otherwise handed off to a separate MSP or internal IT department) as part of a unified Corsica team is key.”

But that view isn’t universal. CEO Craig Stamm of Dallas-based MSSP Zyston said: “That kind of consolidation (MSPs with MSSPs) can happen, but there are real challenges. I don’t expect to see it as a big trend anytime soon. Like-kind consolidation of MSPs with MSPs and MSSPs with MSSPs, I expect, will be much more prevalent.”

Centre’s Pace agreed, noting that “Running a SOC is very different from running a NOC. We’ve chosen to partner. Companies like Secureworks and eSentire and Arctic Wolf are getting big-time dollars dumped into them, and they’ve got huge scale advantages. I just don’t think we want to replicate that.”

Some channel conflicts could arise if an MSP acquired an MSSP, said Todd Ofenloch, Partner at HIG Capital, which owns MSPs Eze Castle and Milestone Technologies. “MSSPs sell through MSPs, so there’s concern that an MSSP you acquire could immediately lose meaningful chunks of revenue. MSPs don’t want to feel like their MSSP is trying to steal their client.”

New COVID-Driven Work Dynamics Drive MSP Revenue

The short-term effects of COVID-driven, work-from-home realities were mildly negative for MSPs – it killed most on-site work that MSPs provide – but as the shifts settled in, enterprises were forced to adapt, and that meant demand for MSPs to help them.

“2020 was a good year overall for MSPs,” said Rick Williams of WestView Capital Partners, which owns several MSPs including AccountabilIT and Abacus Group. “The whole world went remote, and people got comfortable with it. It takes a lot of support to make that transition and to keep it – and I think the pandemic has actually helped confirm the benefits of outsourcing the IT function for many companies.”

Chris Pace explained how remote work drove demand at Centre. “We supported 750 networks before the pandemic. Now, in a sense, we’re supporting 10,000 networks. COVID gives an open door to all the hackers – now they can enter a company’s network in so many different areas.”

North Carolina-based MSP Dynamic Quest saw the same trends. “At the early stages of the pandemic, we had some clients downsize which initially had an impact on our revenue,” said CEO Javier Gomez, “but on the other hand, a lot of companies’ internal IT staffs were just not prepared for the work-from-home wave. That brought us quite a few new clients and around a 25% spike in activity with our existing clients. It more than offset the adverse impact at the start of the pandemic.”

Gillis Cashman of M/C Partners, which owns multiple IT services companies including MSPs Thrive and Ascend Technologies, noted that vertically focused MSPs’ fates were linked to their clients’ industries. “Thrive and Ascend are indexed to financial services and didn’t really have much exposure to retail or hospitality.” But those that did, he noted, probably experienced some of their customers’ pain.

“I think the durability of the sector through the COVID crisis has provided private equity investors more validation than anything,” said Justin Unertl, of Excellere Partners, which owns healthcare IT companies and is seeking new investments in cybersecurity and managed IT services. “The fact that it accelerated technology adoption has reinforced their thesis that this is a great sector for investment. “

Private Equity Loves The MSP Business

The MSP industry seems custom-made for private equity investors. PE firms generally prefer fragmented industries that have strong demand trends, a low risk of obsolescence, have a “sticky” service that creates long-lived customers, are relatively “asset-light”, and have strong cash flow margins.

In addition, PE firms use financial leverage to increase their equity returns, and the more predictable a company’s cash flows are, the more debt lenders will generally be willing to provide. With MSPs doing less and less hardware business and having more and more recurring, contractual revenue, PE firms can use less equity and thereby generate higher returns.

“Many of the better MSPs have 70% or more recurring revenue,” said Southfield’s James.

Riverside’s Del Papa said the primacy of IT in modern business makes MSPs even more attractive. “IT has quite simply moved from being a cost center to being a central part of business strategy.”

And it’s not a one-way love affair. HIG’s Ofenloch said that MSPs with PE backers have significant competitive advantages over less-capitalized competitors. “They can do things that require investment. They can build operations centers in lower-cost regions. They can invest in leading-edge security and applications. They can attract top talent. And for firms with multiple MSP portfolio companies, they can access shared learnings to improve operations.”

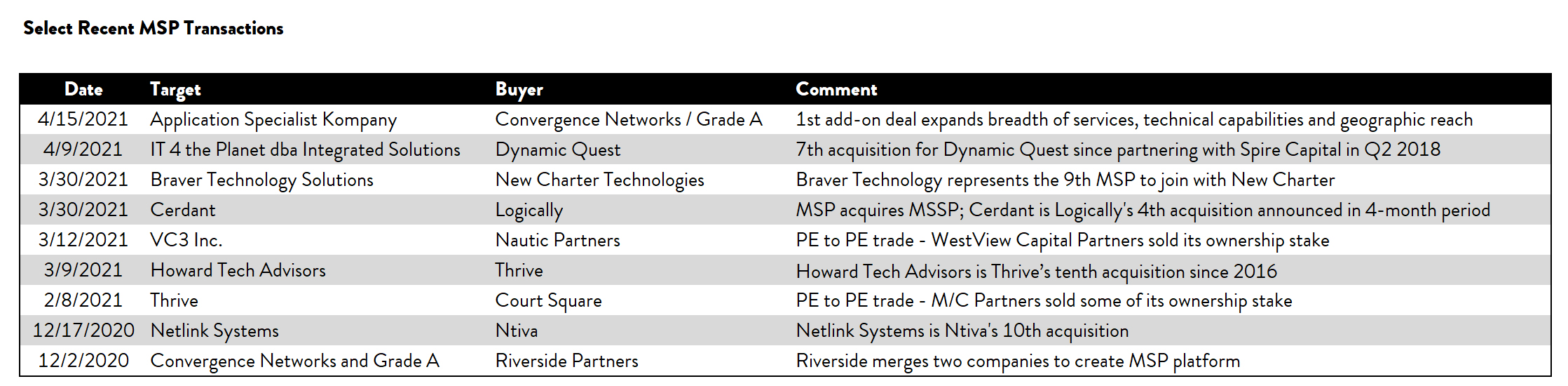

MSP Consolidation

Fragmented industries tend to follow a relatively predictable pattern of consolidation after they’re created by pioneering companies. The MSP consolidation wave is clearly on, fueled by PE dollars and low-interest rates.

“The industry was already starting to consolidate when we first bought into it in 2016,” said Southfield’s James. “Scale was becoming important and things like low-cost help desks were becoming critical.”

“Certain characteristics may become more important in a consolidation phase,” HIG’s Ofenloch said. “We’re seeing the benefits of diversification in end markets,” he said, pointing out that the pandemic brutally punished certain industries while benefitting others. “The average customer size an MSP serves is also a consideration because the financial health of your clients is also seen as more important post-pandemic.”

Dynamic Quest’s Gomez echoed Ofenloch’s thoughts. “I see MSP platform companies acquiring talent in different geographic footprints,” he said. “It’s easier to support larger multi-location clients when you can help the client across many or all of their locations. And, when you acquire another MSP, you have an opportunity where you can offer more services to their customers and in more places than the smaller company you just acquired.”

And it’s not just PE firms eyeing acquisitions, either. “I’m seeing strategic companies out there be more active,” said Riverside’s Del Papa. “Telecom companies that want to move into IT, hosting companies that are looking to add public cloud capabilities, infrastructure providers wanting to add more services around their core…there’s competition (for acquisitions) coming from everywhere.”

Valuation Factors

Not all MSPs are created equal, and several PE investors identified important factors in that differentiation.

“The value you are capable of providing to your clients will take a hit if you don’t have next-generation offerings as technology needs are continuing to grow for all businesses,” said Centre’s Pace. “You really need incremental solutions and real IP that provides expertise and true value so that your clients rely heavily on keeping the partnership.”

Pace also said MSPs with cloud and security expertise will have the highest valuations.

Westview’s Williams said organic growth, high retention rates, and recurring revenue percentages, and healthy end-markets will all play a role. Investors generally will pay incrementally more for talented management teams that are planning to stay on.

Williams also suggested new investors likely can’t expect a downturn in valuations anytime soon. “Demand for MSP acquisitions is great and fundamentals are strong. I expect to see more and more (PE) capital being allocated to the industry.”

“There’s lots of money-chasing deals,” said M/C’s Cashman, “and it’s more competitive at the larger end of the market than the smaller end. If an MSP is viewed as a potential platform company for a PE firm to add acquisitions onto, that would command a higher multiple too.”

Timing The M&A Wave

MSP owners eyeing the exits would justifiably like to time their exit to receive the highest possible valuation. And with good reason: all industry consolidation processes inevitably start slowly, speed up, reach a crescendo, and then, when the consolidating is fundamentally done and there are few buyers left, become less competitive.

When that happens, multiples drop and buyers can afford to become increasingly picky. Those few buyers tend to know exactly who they’re competing with, and in many cases, how each will behave in a competitive auction.

It’s not collusion – it’s just a familiarity that takes the urgency away from a sale process.

But that’s not where the MSP M&A wave is right now. Recent sale processes in the industry have seen as many as 30-40 prospective PE buyers jockeying in the auction, and as industry participants point out, major players from adjacent spaces are eyeing the MSP business as well.

Southfield’s James says he thinks we’re midway through an important first phase. “We’re halfway through the first phase of little guys becoming middle-sized guys. PE firms are buying $1 million to $5 million EBITDA companies and growing them organically and through add-on deals. The next phase, I think, will be larger PE firms consolidating to build $20, $30, or $50 million EBITDA super-regional powerhouses.”

And the bigger the main players become, the less interested they are in paying for small, add-on acquisitions. But for now, it’s game on.

“The sector is white-hot right now,” Excellere’s Unertl said. “It’s a massive global market growing at double-digit rates with new expansion avenues, which is promoting more interest in the sector and higher valuations.”

Long Story Short …

There’s little doubt that both investors and operators believe it’s a good time to be a player in the MSP industry. The tailwinds continue to blow even as the U.S. begins to follow a path back to a new normal.

The Three Cs:

- Cloud: The march to the cloud, having accelerated during the pandemic, continues the growth in demand for the skills that facilitate and protect the capabilities the cloud enables.

- COVID: As the world transitions to a post-pandemic environment, the flexibility of distributed workforces will likely remain -- as will the increased cybersecurity risks it brings.

- Consolidation: Interest in the MSP sector is red hot. The pandemic-tested resilient nature of the industry, combined with the inherent attractiveness of MSP’s business model (capital efficiency, sticky customer relationships, demand growth, strong margins) are driving acquirer and investor interest to new heights. As a result, the window for exit opportunities is wide open.

For MSPs seeking to capitalize on the industry’s growth, key strategic decisions will be required to stay at the forefront of the technology curve. Adjustments and resources will be needed for the post-pandemic environment, and consolidation will mean increasingly sharp-elbowed competition from scaled-up players. Owners seeking to cash in on a sale, on the other hand, are likely to find a gaggle of eager bidders.

About The Authors

Mike McGill and Kevin Jolley are Managing Directors, Investment Banking, at Cowen and Company, LLC: Member NYSE, FINRA, and SIPC.