Special Report: IT Insights 2017

By The Business Solutions Network

Survey data reveals the hottest verticals and technologies in 2016, and what solutions providers are focusing on for 2017.

Each December, we have the opportunity to look back on the past 11 months, while also keeping an eye on the next 12. It’s a chance to celebrate our biggest wins and learn from our failures, plan for the future, and prepare for change. For some, the necessary changes are obvious. For others, not so much. For some, changes might be in the form of minor adjustments to squeeze a little more out of an already successful business. For others, the changes might be aggressive and significant.

No matter the situation you find yourself in this December, it helps to have an understanding of what the rest of the industry is experiencing and where one’s peers are focused for 2017. To this end, Business Solutions reached out to a random sampling of readers to learn more about their businesses, technologies, and markets. The results of the survey can be a useful point of reference as you look toward the new year.

Profile

The data collected in this report came from 92 U.S.-based solutions providers classifying themselves as either VAR, managed services provider (MSP), ISV, ISO, or integrator. The median number of active customers per respondent is 313. Those who participated conduct business in a variety of different verticals. Because technologies sold and market conditions differ by vertical, we looked at the data in a variety of ways. In some cases, holistically, and in others, separated by VAR and MSP.

Verticals: Where’s The Money?

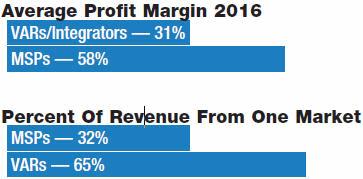

We asked readers to indicate not only which verticals they operated in, but also which one vertical provided the most revenue. According to the results, solutions providers get, on average, 59 percent of their revenue from one market. However, when we delineate between VARs and MSPs, we learn that MSPs are more diverse in their vertical focus. On average, MSPs earn approximately one-third of their revenue from their one top market. VARs indicated that 65 percent of their revenue comes from their top vertical, indicating that VARs find their niche and mostly stick to it.

With these same MSPs there was a four-way split between what that one market is that’s providing the lion’s share of revenue — healthcare, education, manufacturing, and financial. For VARs, the most lucrative verticals are restaurant and retail.

This difference between MSPs and VARs isn’t surprising, but it’s worth discussing. Many VARs have a business that’s centered around providing one solution type and are, therefore, more vertically focused. On the other hand, MSPs provide services that are mostly horizontal in nature, opening up their potential customer base to a wider array of verticals. While an economic downturn can negatively affect any solutions provider, MSPs can probably more easily weather one simply due to the diversity of their customer base. This doesn’t even take into account the subscription nature of MSP business that further insulates them from budget cuts.

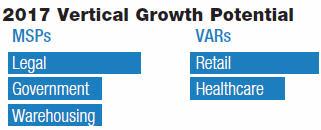

In addition to identifying which verticals provide the most revenue, we also asked readers to identify the verticals that they felt provided the most growth potential in 2017. For MSPs, the majority sees the most growth potential in 2017 from legal, government, and warehousing/distribution verticals. In fact, approximately one-third of respondents indicated legal as having the most growth potential. When we asked respondents to explain why they have such growth expectations for the legal vertical, reasons were varied, making us unable to pin down a common cause for such optimism.

For VARs, retail and healthcare hold the most growth potential for 2017. Whereas reasons varied for MSPs and their expectations for the legal vertical, things were clearer on the VAR side. Within retail, VARs indicated that new POS and payment technologies are creating opportunities. For healthcare, VARs cited security and HIPAA compliance as primary drivers.

For VARs, retail and healthcare hold the most growth potential for 2017. Whereas reasons varied for MSPs and their expectations for the legal vertical, things were clearer on the VAR side. Within retail, VARs indicated that new POS and payment technologies are creating opportunities. For healthcare, VARs cited security and HIPAA compliance as primary drivers.

We also looked at which verticals are most concerning for 2017, whether due to market conditions, increased competition, or some other external factors. For MSPs, the vertical causing the most concern is healthcare, at 37 percent. The primary reason for this concern stems from uncertainty around governmental changes put in motion as a result of the recent presidential election. The second most concerning vertical is education at 27 percent. The primary reason given by MSPs for concern in the education vertical is budget cuts.

For VARs, the biggest vertical concerns come from restaurant (39 percent) and retail (26 percent). The most common reasons cited for this concern in restaurant are perceived low end, subscription-based solutions coming to market, driving down margins. While sophisticated restaurateurs might demand more traditional POS solutions with robust capabilities, many smaller restaurants are fine with considerably less. At the same time, more payment companies are realizing that to win processing share, they need to provide sticky solutions such as bundled hardware and software provided at a low monthly cost. There is no reason to think that this trend will reverse, and POS VARs focused on restaurants, and even retail, have their work cut out for them. In the meantime, traditional POS software companies are coming up with their own ways to stay or regain relevance.

On the retail side, VARs are most concerned about the effect Amazon is having on the industry, forcing many businesses to close or shift to an e-commerce model. Savvy VARs are already pushing their retail customers to adopt some form of e-commerce to remain relevant and open up new sales opportunities.

On the retail side, VARs are most concerned about the effect Amazon is having on the industry, forcing many businesses to close or shift to an e-commerce model. Savvy VARs are already pushing their retail customers to adopt some form of e-commerce to remain relevant and open up new sales opportunities.

We also asked readers to share which markets, if any, they plan on moving into for 2017 as new business. Many VARs — 32 percent, in fact — indicated that they will not be moving into any new verticals next year. The “none” option was the most selected. The number two choice of VARs was retail (23 percent), followed by hotels/lodging and restaurant (both around 16 percent). Otherwise, VARs are spread on which market will be their new business market next year. The fact that 23 percent are moving into retail in 2017 is interesting, particularly when you consider the concerns we just discussed. Many of these optimistic VARs cite untapped merchants and the SaaS model as their reasons for moving into the space.

On the MSP side, a whopping 64 percent indicated that they will not be targeting any new verticals in 2017. One has to wonder if this is because MSPs are already so diverse in their market mix. That said, 18 percent of respondents indicated legal as their expansion vertical next year. Again, there was no clear reason why this was the case.

Products And Services

Shifting away from verticals to products and services, we learn that MSPs get their most revenue from Remote Monitoring and Management (RMM), Backup and Disaster Recovery (BDR), video surveillance, and Unified Communications and Collaboration (UC&C). While RMM and BDR aren’t surprising to see on the list, it’s refreshing to see video surveillance and UC&C make the list. When asked to share which service provides the highest margins, 56 percent of MSPs indicated BDR, 33 percent indicated RMM, and 22 percent UC&C. The overall average profit margin among MSPs for 2016 is a healthy 58 percent.

VARs indicated that they sell a wide variety of solutions, with traditional POS technologies and payment processing coming in as the two generating the most revenue. Not surprisingly, the highest margins come from payment processing. For VARs, the overall average profit margin is 31 percent.

Among all solutions providers and the possible technologies they sold in 2016, RFID and IoT sensors received the lowest vote counts. With the buzz surrounding IoT, I’d see an opportunity in the fact that so few competitors are selling these technologies.

As far as growth potential is concerned, a healthy 44 percent of MSPs indicated that video surveillance has the most potential for them in 2017. Some respondents cited a new focus on offering managed (physical) security as the reason for this optimism. The biggest technology concern among MSPs is RMM. Forty-three percent cited it as the most concerning technology for 2017. Some commented that RMM has become a commodity.

As far as growth potential is concerned, a healthy 44 percent of MSPs indicated that video surveillance has the most potential for them in 2017. Some respondents cited a new focus on offering managed (physical) security as the reason for this optimism. The biggest technology concern among MSPs is RMM. Forty-three percent cited it as the most concerning technology for 2017. Some commented that RMM has become a commodity.

Nearly 35 percent of VARs indicated that POS-as-a-Service solutions are expected to provide them the most growth potential in 2017. Many indicated the reason for this optimism as “this is the future of our industry” and “the model is proven effective.” Other notable technologies expected to help growth are payment processing and POS tablets. The most concern is with payment processing and POS-as-a-Service. Thirty-one percent felt each was the biggest concern for 2017. The primary reasons behind these numbers are low margins and competitive pressures. Interesting that some view POS-as-a-Service as offering the biggest potential, while nearly as many view it as a threat.

We also asked about the evaluation of new technologies. VARs, pay attention here. Approximately 25 percent of MSPs indicated an interest in evaluating traditional POS technologies in 2017. Thirty-seven percent indicated an interest in POS tablet solutions. Interestingly, only 13 percent indicated an interest in payment processing. Either these MSPs are already selling processing or they don’t realize that to successfully sell POS (traditional or tablet/mobile), they will need to get involved in the payments game. Regardless, for VARs already feeling the pressures of competition from ISOs, banks, and payment companies, there could be retail- and restaurant-focused MSPs entering the fray.

For VARs, the appeal of POS-as-a-Service is too great for many. Indeed, 32 percent indicated that they’ll be evaluating it in 2017. Twenty-five percent indicated an interest in evaluating RMM solutions. Beyond these top two technologies/offerings, the data shows that VARs have a lot of interest in evaluating many technologies. This could be indicative of the pressures many VARs are feeling to break outside their traditional offering and move into complementary services and solutions.

With the shift to POS-as-a-Service taking place, we also looked at the individual components of such an offering in an attempt to identify the highest margin components. From the responses, it’s again no surprise that payment processing services provide the most margin for many. However, it’s not a clear-cut win. Only 32 percent of respondents identified payment processing as the highest margin source. Twenty-three percent identified business continuity (backup and disaster recovery) as their high-margin service. Twenty percent identified both POS hardware and software, as well as remote monitoring and management. This spread in results serves as a lesson to anyone offering POS-as-a-Service. Don’t assume that the “Service” you offer ends with POS and payment. There are plenty of solutions providers making better margin on BDR and RMM, and you’d be wise to include them both in your offering.

Other Trends

In addition to focusing on verticals and technologies, we sought to understand the current feelings toward some of the bigger trends shaping the industry today. With malware affecting every industry, 46 percent of respondents indicated that they had a strong focus on endpoint security in 2016. Sixty-five percent plan a strong focus for 2017, nearly a 20 percent increase.

For those in the payment and POS world, EMV isn’t going away any time soon. Twenty-one percent of respondents agree or strongly agree that EMV was a big focus for their company in 2016. Twenty-six percent agree or strongly agree that it will be a big focus for them in 2017. These numbers are surprisingly low in some ways (because we need more movement) and not surprising in others (because VARs are so burnt out on failed promises by payment companies). However, the fact remains that EMV is something many merchants need to address. If you aren’t the one offering the solutions, you leave the door open for a competitor.

Finally, we asked about the cloud. Fifty-nine percent agreed or strongly agreed that cloud delivery of solutions was a big focus for their company in 2016. That number shoots up to 72 percent who agree or strongly agree that cloud delivery of solutions will be a big focus for their company in 2017.

Conclusion

Clearly, these results are just a sampling of the total channel. Your market conditions, capabilities, and personal situation might create a different 2017 than we saw generated from our survey. Still, it’s helpful to get a glimpse into what your competitors are thinking — whether to open your eyes to opportunities or threats.