Private Equity Remains A Dominant Force In MSP Consolidation

By Mike McGill, Kevin Jolley, and Sam Bahmanya, Cowen and Company, LLC, Member NYSE, FINRA, and SIPC

M&A activity among U.S.-based, IT managed service providers (MSPs) remained robust in 2022, despite numerous headwinds, including the ongoing war in Europe, rising interest rates, runaway inflation, and a precipitous drop in the stock market with continuing volatility. Not surprisingly, private equity (PE) firms continued to be the dominant force in MSP consolidation.

Cowen analyzed more than 100 MSP M&A transactions that were announced or closed in 2022. This level of transaction activity reflects a brisk pace of industry consolidation, continuing the growing momentum of the last few years. Among the transactions we analyzed, private equity firms were involved in approximately two-thirds of all deals. In comparison, 2017 transaction data showed only 23 MSP M&A transactions, with private equity being involved in 43% of the deals.

In 2022, PE investments included establishing new MSP platforms (≈12% of all MSP-related transactions), adding smaller businesses to an existing platform (≈48%), and platforms sold by one PE firm to another (≈5%).

Cowen is currently tracking more than 75 PE-owned MSPs in the United States. This number has steadily increased as more PE firms pursue buy-and-build strategies in the industry. As the number of PE-owned platforms continues to increase, so will PE’s influence on industry consolidation.

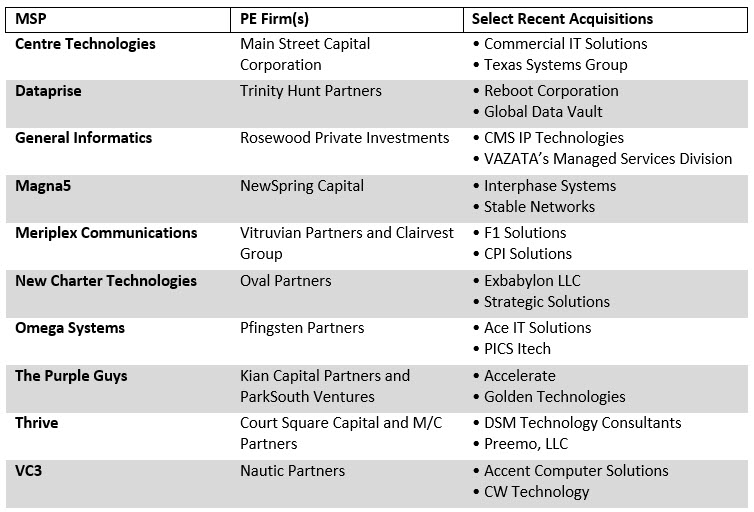

Some notable PE-owned consolidators are shown below.

MSPs serving the small and midsized business (SMB) market are becoming increasingly attractive to PE firms. One of the primary reasons is the IT managed services industry for SMBs is large, growing, and considered a defensive industry in recessionary times. Cowen estimates the total addressable market in the U.S. for MSPs serving SMBs to be more than $60 billion annually and industry analysts project managed services revenue to grow at a high-single-digit to low double-digit cumulative average growth rate over the next several years. Several factors are driving industry growth, including:

- The ever-increasing complexity of information technology

- Technology is mission critical for businesses of all sizes

- Rising concerns about cybersecurity

- Cost effectiveness of outsourced IT services coupled with a skills shortage within the IT industry

- Limited resources of SMB organizations

Other factors that make MSPs serving SMBs highly attractive are:

- The recurring revenue model used by MSPs establishes a sticky customer relationship and provides visibility into future financial performance

- The large, fragmented industry presents ongoing M&A opportunities. Some estimates put the number of MSPs serving the SMB market at more than 20,000

Cowen recently observed firsthand the strong interest among private equity firms in MSPs serving the SMB market. We served as the exclusive financial advisor to CMIT Solutions, an MSP franchisor with more than $100 million in systemwide revenue, in a recapitalization transaction that closed at the end of 2022 with private equity firm HKW. HKW was the winning bidder in a highly competitive sale process with many PE firms aggressively pursuing a partnership with CMIT.

Given the strong fundamentals of the MSP industry, PE interest in the sector isn’t expected to wane anytime soon. Cowen expects 2023 to be another active year of consolidation with PE firms leading the way.

About The Authors

Mike McGill, Kevin Jolley, and Sam Bahmanyar are senior professionals in Investment Banking at Cowen and Company, LLC, Member NYSE, FINRA, and SIPC.