Benchmark Data For Key Practice Differences Between TSPs And OEMs

By Jeff Connolly, TSIA

Managed services (MS) practices within Technology Services Providers1 (aka, non-original equipment manufacturers, non-OEMs) tend to:

- Be larger than MS businesses within Original Equipment Manufacturers (aka, OEMs, such as Hardware Manufacturers and Software Providers).

- Contribute a larger percentage of overall company revenue than OEM MS businesses.

- Be more strategic to the business as a whole.

However, TSP’s Key Performance Indicators (KPIs) lag behind OEMs in almost every measure. Why is this the case and what can you do about it?

Technology Services Industry Association And The Managed Services Benchmark Database

TSIA is an industry association that helps technology companies achieve profitable growth and solve their top business challenges with data-driven, expert advice and community learning.

We're a group of data fanatics who want to help you make informed, fact-based decisions so your business can be at its best. Through our data, community, and outcome-based approach, TSIA gives you the in-depth best practices research, thought leadership, and data-driven expert advice your technology company needs to get the business results you want, faster.

All the data that follows is derived from TSIA’s MS Benchmark database, updated in January 2019, collected from over 100 MS providers.

The Top 8 Managed Services Metrics To Measure

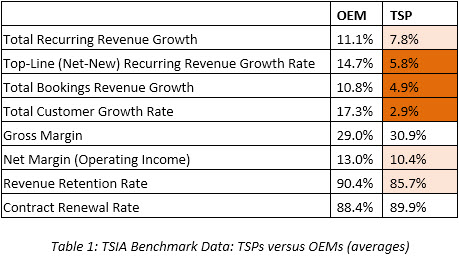

In our TSIA member report, The Top 8 Managed Services Metrics to Measure, we identify and define the key performance indicators that we recommend all managed services providers track in order to gauge the health of their business. When we compare the performance on these Key Performance Indicators (KPIs) across OEMs and TSPs, we see that TSPs lag on almost every key metric:

We see TSPs leading in two metrics, bookings growth and contract renewal rates, but lagging in all other KPIs. For any managed services practice, the main priorities are to grow revenue, to make sure that it is profitable revenue, and to hold onto that revenue. By all three measurements, TSPs are lagging.

Profile Differences

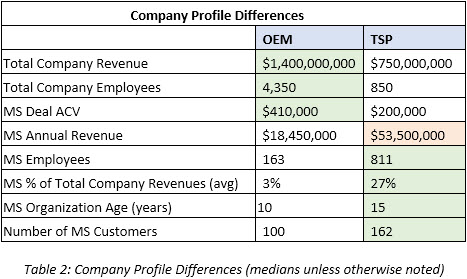

Some key demographic differences we see between OEM and TSP MS providers drive some of the differences we see in their behaviors, shown in Table 2.

In general, OEM companies are larger in revenue and employee size, and in the size of their MS deals (annual contract value, or ACV) versus TSPs.

MS practices in TSPs tend to be more mature, larger in MS employee and customer size, and account for a larger percentage of overall company revenue versus OEMs.

This data corresponds with our qualitative MS experience at TSIA — TSP members who join our MS discipline typically have large MS practices that are more critical and strategic to their overall business. OEM members are generally larger companies, but their MS practices are generally a smaller part of their overall business and less strategic to those businesses than their TSP counterparts.

OEMs in the MS Benchmark derive the largest portion of their services revenue from support services, whereas TSP MS members have the largest portion of their services revenue coming from MS. We see this play out in many of our OEM member accounts - for OEMs, maintenance is usually the primary services driver, followed by PS, and then MS. OEMs are more likely to have MS practices that rely on, or have grown out of, their support services operations, which is less often the case for non- OEMs. This also means that MS strategy is more important to TSPs overall, as they rely on MS for a greater proportion of their revenue, thus the risk/reward is higher.

In a TSIA member-only research paper (Managed Services for Non-OEMs What the Data Tells Us), we compare, at length, detailed benchmark data for key practice differences between TSPs and OEMs. For the purposes of this article, we will simply summarize the key findings of that report below, grouped by functional discipline within the managed services practice:

Strategy And Offer

- OEMs utilize resellers more often, view them as more critical, and develop MS offers for those channels far more often than TSPs MS businesses, which leads to better outcomes associated with these practices.

- TSPs tend to customize MS offers more frequently, which tends to negatively impact performance.

Sales And Go-To-Market

- OEMs are far more likely to have a formal deal review process and to staff that deal review with cross-discipline leadership, which leads to better outcomes.

Service Delivery

- The overall strength and maturity of TSP service delivery may be offsetting some of the deficient practices in other areas of the business.

Business Operations

- OEM MS practices are more mature in the adoption of customer success than TSPs, and the adoption of these practices are associated with powerful outcomes.

TSIA Recommends

TSP MS businesses are growing and growing profitably - but now is not the time to look at single-digit growth and believe that the world is fine. Better MS performance is staring at TSPs right across the street from their OEM partners/competitors.

It’s not just that OEMs are achieving bigger and more profitable deals — the data is showing us that OEMs have instituted key practices that drive better results — key practices that TSPs can adopt as well.

We identified some proven practices that TSPs should assess to see how they fit within the priorities of their own businesses. Again, in the interest of brevity for this article, we will simply summarize the key findings that the data suggests from our aforementioned report, below:

Strategy And Offer

- Develop channel partners aggressively and customize MS offers specifically for channel resale.

- Standardize the service catalog and service offers.

Sales And Go-To-Market

- Formalize the deal review process for MS, with adequate cross-functional representation.

Services Delivery

- TSPs have comparative overall strength in this category and, generally, shouldn’t likely view this category as their number one investment priority.

Business Operations

- Formalize the MS base revenue review process.

- Build a dedicated MS customer success function for contracting and renewals.

What To Do About It

Advise is easy, but knowing where to start is difficult, with many different projects offering clear improvement opportunities. When deciding where to make incremental investments, TSIA Research recommends:

- Benchmark your current performance against other members. How does your company compare to the benchmark practices and metrics shown? How do you compare to the industry in general versus your peer group versus pacesetter performance? Our MS benchmark program also provides prescriptive, prioritized initiatives, backed by TSIA recommended research based on this deeper understanding of your business.

- Beware the law of diminishing returns. For example, service organizations with a very large percentage of standard offers are unlikely to see the same outcome improvements in implementing a deals desk as companies with mostly custom offers (as the deals desk can help significantly with streamlining the handling of custom quotes). Be realistic in expectation- setting and talk to TSIA about typical outcomes. When trying to identify where to start with a series of projects, benchmarking is a good first step. Identify the key metrics you would like to improve, and then target a practice with a successful track record of impacting those metrics.

- When in doubt, ask. TSIA Research is here to help. Members can submit an inquiry on any topic and we will do our best to answer within 48 hours. To submit an inquiry, send an email to your membership success manager or to support@tsia.com and someone will respond to you as quickly as possible.

TSIA is committed to helping TSPs grow their technology services practices efficiently and effectively. To that end, in 2018, we newly established a TSP Advisory Board, so that we may strengthen our relationship with this community, help drive improvements specifically within TSP managed services businesses and help mediate the conversation between TSPs and OEMs more effectively.

Footnotes

1TSIA defines TSPs as providers of technology services that do not obtain the majority of their revenue from the manufacturing and sale of hardware or software, and includes companies such as VARs, MSPs, SPs, SIs, IT outsourcers, BPOs, and ISVs.

About The Author

Jeff Connolly is the Sr. Director, Managed Services Research for TSIA. He is a managed services veteran, with over 20 years of experience in defining, building, launching and managing cloud and managed services businesses in the technology industry. In his role at TSIA, Jeff provides members with fact-based education and insight into the performance and operations of managed services providers of all sizes.